When you’re in a financial pinch, the last thing you want is to wait weeks for a personal loan to be approved. Here are a few methods to get a personal loan with fast approval.

Can We Get A Personal Loan If The Credit Score Is Bad?

There’s no question that having a good credit score is important. A high credit score means you’re a low-risk borrower, which can lead to lower interest rates on loans and other financing products.

And if you ever need to borrow money, having a good credit score is essential.But what if your credit score is bad? Can you still get a personal loan? The good news is that, in most cases, you can still get a personal loan with a bad credit score. However, with bad credit loans, you may need to pay a higher interest rate and you may be required to provide a guarantor. So, if you’re looking for a personal loan and you have a bad credit score, don’t despair. There are still plenty of options available to you.

What Are Fast Ways To Apply For A Personal Loan Online?

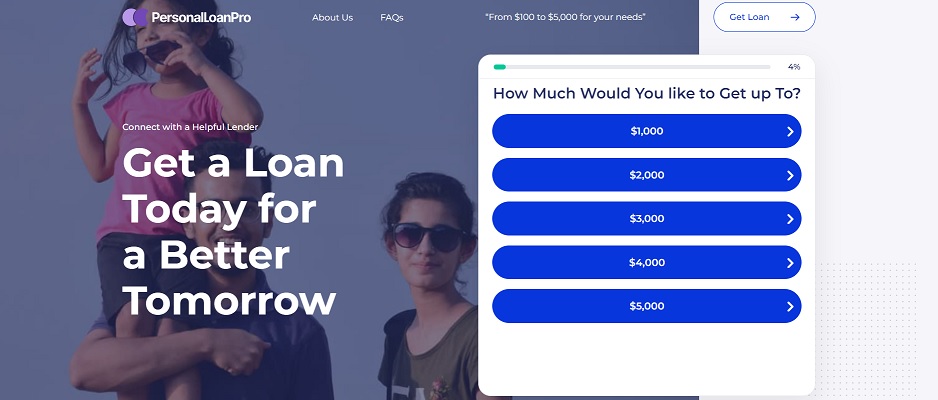

It can be tough to get a personal loan if you need it quickly. Traditional lenders can take weeks or even months to process a loan application. But there are now a number of online lenders or Brokers like Personal Loan Pro that offer personal loans quickly, sometimes within minutes. So if you need fast access to cash, here are three fast ways to apply for a personal loan online.

1. Use A Direct Lender

1. Use A Direct Lender

There are a number of direct lenders that offer personal loans online. These lenders typically process applications quickly and can provide a decision in minutes. However, the interest rates and terms may not be as competitive as those offered by online marketplaces.

2. Use A Peer-To-Peer Lender

Peer-to-peer lenders like Lending Club and Prosper offer personal loans online. These lenders use a screening process to match borrowers with investors who are willing to fund their loan. This can be a quick and easy way to get access to cash, but the interest rates may be higher than those offered by traditional lenders.

3. Use An Online Marketplace

Online marketplaces like Personal Loan Pro offer a quick and easy way to apply for a personal loan with fast approval. You can complete an application in minutes and receive a decision in seconds. These marketplaces also offer a wide range of lenders, so you can comparison shop to find the best loan for your needs.

If you need a personal loan quickly, one of these three methods is the best way to apply.

If you need a personal loan quickly, one of these three methods is the best way to apply.

How Much We Can Borrow From An Online Personal Loan?

Borrowing from an online personal loan can be a great way to get the money you need to cover a financial emergency. However, it’s important to understand how much you can borrow and what the terms of the loan will be.

Most online personal loans have a borrowing limit of $5,000 or less. The amount you can borrow will depend on a number of factors, including your credit score, income, and debt-to-income ratio.

Be sure to read the terms of the loan carefully before you apply. You’ll want to know the interest rate, the loan term, and any fees that will be charged. It’s important to remember that online personal loans should only be used for short-term financial needs. They are not meant to be used as a long-term solution for debt consolidation or other financial problems.

How Much Does It Cost To Take A Personal Loan?

When you’re in a bind and need some extra cash, a personal loan might be the answer. But before you take out that loan, it’s important to know what you’re getting into. How much will you have to pay back each month? And what are the interest rates?

To get a sense of what you might expect to pay, we took a look at interest rates and monthly payments for personal loans offered through Personal Loan Pro, one of the largest online loan brokers.

The interest rates on personal loans range from 5.99% to 29.99%, and the monthly payments vary depending on the amount of the loan and the interest rate. For example, if you take out a $5,000 loan with a 5.99% interest rate, your monthly payment would be $104. If you have a higher interest rate, your monthly payment will be higher. For example, if you take out a $10,000 loan with a 29.99% interest rate, your monthly payment would be $287.

It’s important to remember that these are just examples. Your interest rate and monthly payment will vary depending on your credit score and other factors. So, how do you know if a personal loan is the right choice for you? It depends on your individual situation. But if you need a little extra cash and you’re willing to pay back over a period of time, a personal loan could be a good option.